What actually happened?

This week, the CEO (now former) of FTX, Sam Bankman-Fried (SBF) found himself at the center of a major controversy that ultimately led him to file the company for bankruptcy. FTX and Alameda Research were his two largest companies and contributed significantly to his previous net worth of $16 billion, although in total he filed bankruptcy for 130 affiliated companies. Unprecedented losses were experienced around the globe as investors said goodbye to their funds which were trapped inside the exchange. Some reports suggest that as much as $1-2 billion worth of customer funds have seemingly “vanished” from the exchange after revelations came out that the company had loaned approximately $10 billion dollars worth of customer funds to Alameda Research.

The downfall of FTX and Alameda ultimately started over Twitter, as do most most downfalls of billion dollar companies.

This tweet, made by Binance CEO Changpeng Zhao (CZ), in conjunction with a report that outlined the holes in Alameda’s balance sheet, sparked a “bank run”. As much as $6 billion dollars was withdrawn from the exchange in a space of 72 hours. Soon it became apparent FTX could not provide enough liquidity to process all these withdrawals, prompting the exchange to halt withdrawals.

To combat this issue, CZ proposed a non-binding agreement where Binance would provide assistance to FTX to assist them with their liquidity issue. This was an agreement that never transpired because after investigating the finances of FTX, Binance backed out of the deal.

The issue with Alameda’s balance sheet was that a large amount of their assets were held in the form of crypto tokens (mainly FTX’s native token FTT and SOL). The issue was that these “assets” were technically illiquid and selling them all at once would tank the value of the. Around this time it also came out that allegedly SBF had built a custom “backdoor” into FTX’s bookkeeping system. Some speculate that this could be the way in which $1-2 billion worth of customer funds seemingly disappeared. The saga continued with SBF taking to twitter to issue an apology statement trying to clear the air and provide customers with some reassurance that their funds were safe. He ended the series of tweets by congratulating his biggest competitor.

At the time of this article, this is the last public outreach made by the former CEO who is now keeping his cards close to his chest. Mirroring the recent Luna crash, the FTT chart resembled a striking resemblance and illustrates a picture of just how much devastation has occurred.

People have lost their entire life’s savings, retirement funds and some people are even now in debt because they can’t withdraw their assets. This devastating situation has been a reminder of how volatile crypto markets can be and how important it is to store assets on a hardware wallet.

Where is SBF?

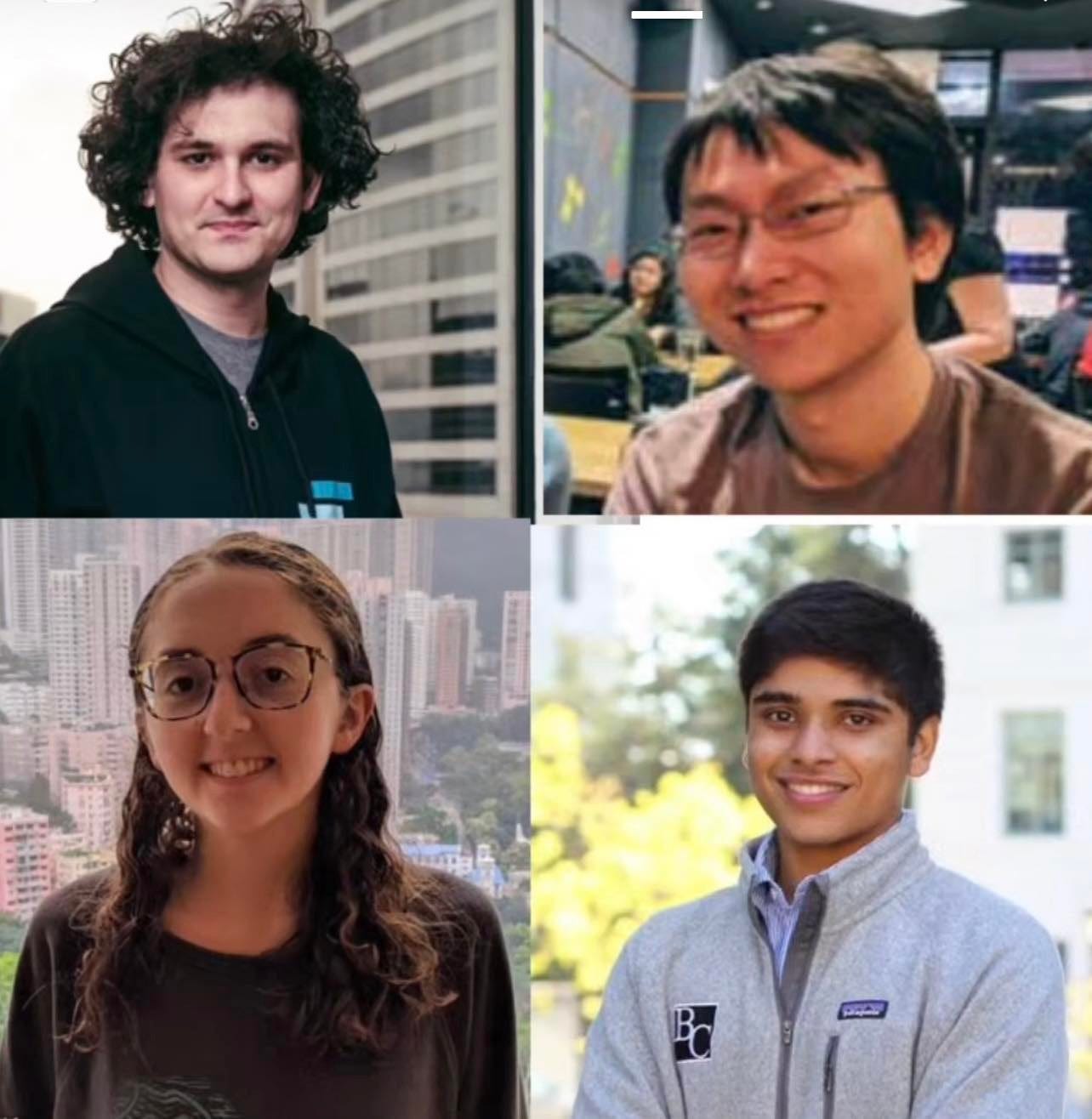

After all of this broke, reports started to emerge that SBF was intending to fly to Argentina, possibly in an attempt to avoid prosecution. According to Flightradar24, “the most tracked flight at 3:33 a.m. on Nov. 12, 2022, was Sam Bankman-Fried’s (SBF) private jet flying from the Bahamas to Argentina.” So there is evidence to suggest that SBF flew to Argentina, although he claims he’s still in The Bahamas. Cointelegraph corroborated this, reporting that SBF, FTX co-founder Gary Wang and director of engineering Nishad Singh are “under supervision” by local authorities in The Bahamas. Since SBF has gone quiet on Twitter there leaves a lot of room for speculation, but it is understood he is now accompanied by his Stanford professor father, Joseph Bankman.

It was this same day that rumors of a hack started coming out, allegedly $600 million worth of digital assets were siphoned out of FTX’s crypto wallets. There was also a report published that speculated the former CEO of Alameda Research, Caroline Ellison, who is currently in Hong Kong, had plans to flee to Dubai. She was allegedly planning this alongside SBF, Gary Wang and Nishad Singh on the basis that Dubai had no extradition agreements in place with the US. This was true up until February of this year when a bilateral agreement was established, so it no longer makes sense.

What happens now?

Well unfortunately for those who had any assets stored on FTX, it’s likely you’ll never see your funds again. Currently FTX is at the center of a criminal investigation being undertaken by bohemian authorities and local security regulators are assisting to determine if any criminal conduct has occurred. The case is still developing and many speculate that this could be just the tip of an iceberg.